Hala Municipal Tax Collection Auction 2025-26: Bid on Market, Parking & Ad Fees

Tender Category:

Tax Collection Rights (Outsourcing)

Extracted Text & Table

OFFICE OF THE MUNICIPAL COMMITTEE HALA

AUCTION NOTICE

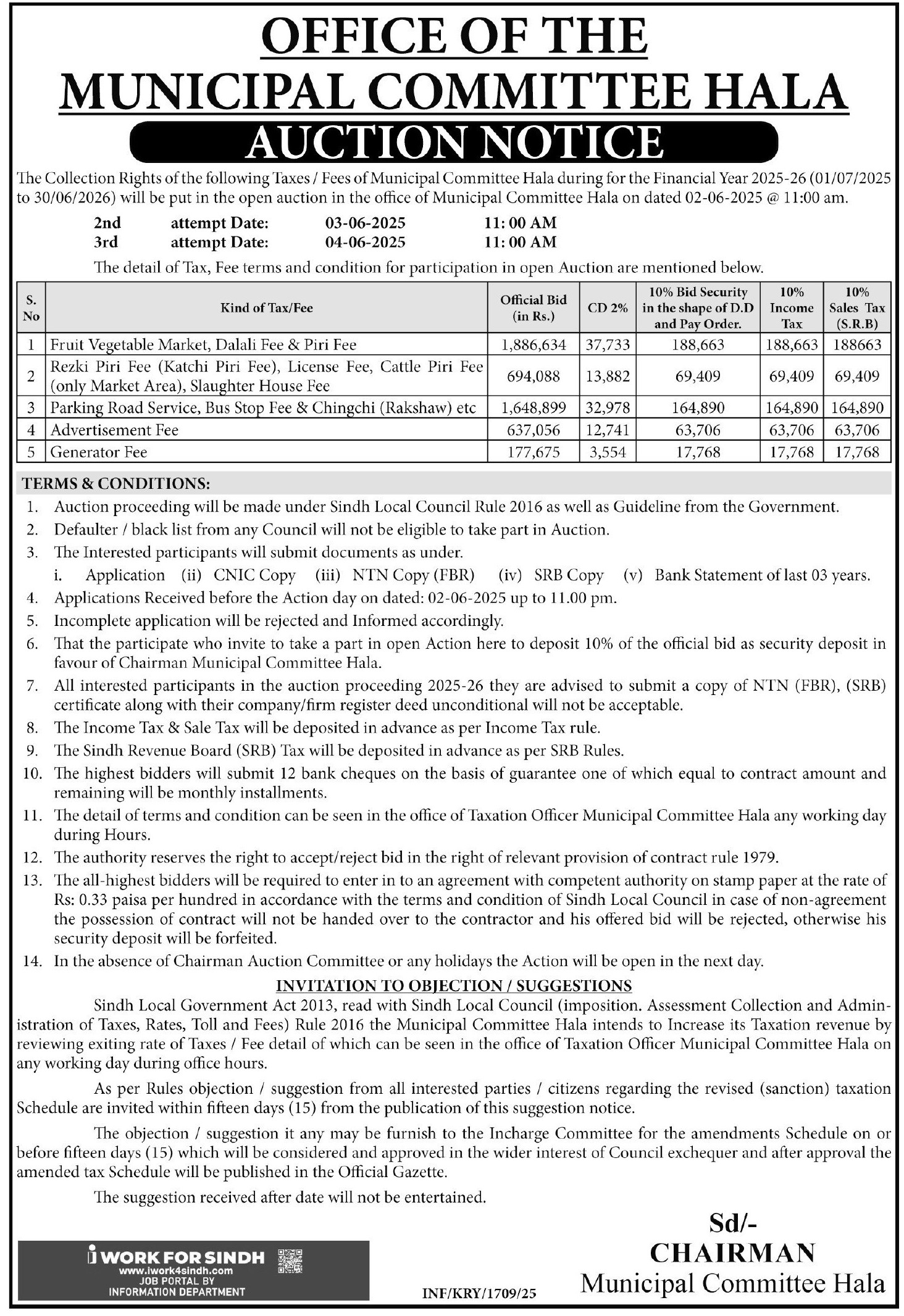

The Collection Rights of the following Taxes/Fees of Municipal Committee Hala for the Financial Year 2025-26 (01/07/2025 to 30/06/2026) will be auctioned openly at the Municipal Committee Hala office on 02-06-2025 @ 11:00 am.

- 2nd attempt Date: 03-06-2025 @ 11:00 AM

- 3rd attempt Date: 04-06-2025 @ 11:00 AM

Tax/Fee Details for Auction:

| S. No | Kind of Tax/Fee | Official Bid (Rs.) | CD 2% (Rs.) | 10% Bid Security (Rs.) | 10% Income Tax (Rs.) | 10% Sales Tax (SRB) (Rs.) |

|---|---|---|---|---|---|---|

| 1 | Fruit Vegetable Market, Dalali Fee & Piri Fee | 1,886,634 | 37,733 | 188,663 | 188,663 | 188,663 |

| 2 | Rezki Piri Fee (Katchi Piri Fee), License Fee, Cattle Piri Fee (Market Area), Slaughter House Fee | 694,088 | 13,882 | 69,409 | 69,409 | 69,409 |

| 3 | Parking Road Service, Bus Stop Fee & Chingchi (Rakshaw) etc | 1,648,899 | 32,978 | 164,890 | 164,890 | 164,890 |

| 4 | Advertisement Fee | 637,056 | 12,741 | 63,706 | 63,706 | 63,706 |

| 5 | Generator Fee | 177,675 | 3,554 | 17,768 | 17,768 | 17,768 |

TERMS & CONDITIONS:

- Auction under Sindh Local Council Rule 2016 & Government Guidelines.

- Defaulters/blacklisted individuals from any Council are ineligible.

- Required Documents:

i. Application

ii. CNIC Copy

iii. NTN Copy (FBR)

iv. SRB Copy

v. Bank Statement (last 03 years). - Applications accepted until 02-06-2025 @ 11:00 AM.

- Incomplete applications will be rejected.

- Participants must deposit 10% of the official bid as security (via DD/Pay Order) in favour of Chairman Municipal Committee Hala.

- Submit NTN (FBR), SRB certificate, and company/firm registered deed copy. Unconditional documents unacceptable.

- Income Tax & Sales Tax must be deposited in advance per rules.

- Sindh Revenue Board (SRB) Tax must be deposited in advance per SRB Rules.

- Highest bidders must submit 12 bank cheques: 1 equal to contract amount + 11 monthly installments.

- Full terms available at Taxation Officer’s office (working hours).

- Authority reserves right to accept/reject bids per Contract Rule 1979.

- Highest bidders must sign an agreement on stamp paper (Rs. 0.33 per hundred). Non-compliance = bid rejection & security forfeiture.

- Auction postponed to next day if Chairman absent/holiday.

INVITATION TO OBJECTION / SUGGESTIONS

Per Sindh Local Government Act 2013 & Sindh Local Council Rules 2016, objections/suggestions regarding revised tax rates are invited within 15 days of this notice’s publication. Submit to Incharge Committee. Late submissions ignored. Approved amendments will be gazetted.

WORK FOR SINDH

www.workskindh.com

INFORMATION DEPARTMENT

INF/KRY/1709/25

S.NO | TITLE | DETAILS |

|---|---|---|

| 1. | Published Date | 28 MAY 2025 |

| 2. | Last Date to Apply | MENTION IN ADVERTISMENT |

| 3. | Newspaper Name | Tribune Express |